The ATO's generosity around collections is reflected in the national budget figures. We undertook a deep dive into those figures and found that since the ATO suspended its normal collection strategy in around April last year, Australian businesses owe the ATO more than ever. Between 1 July 2020 and 31 March 2021, only six bankruptcies and three corporate wind-ups have been the result of ATO initiated legal action.

Uncollected taxes to keep increasing

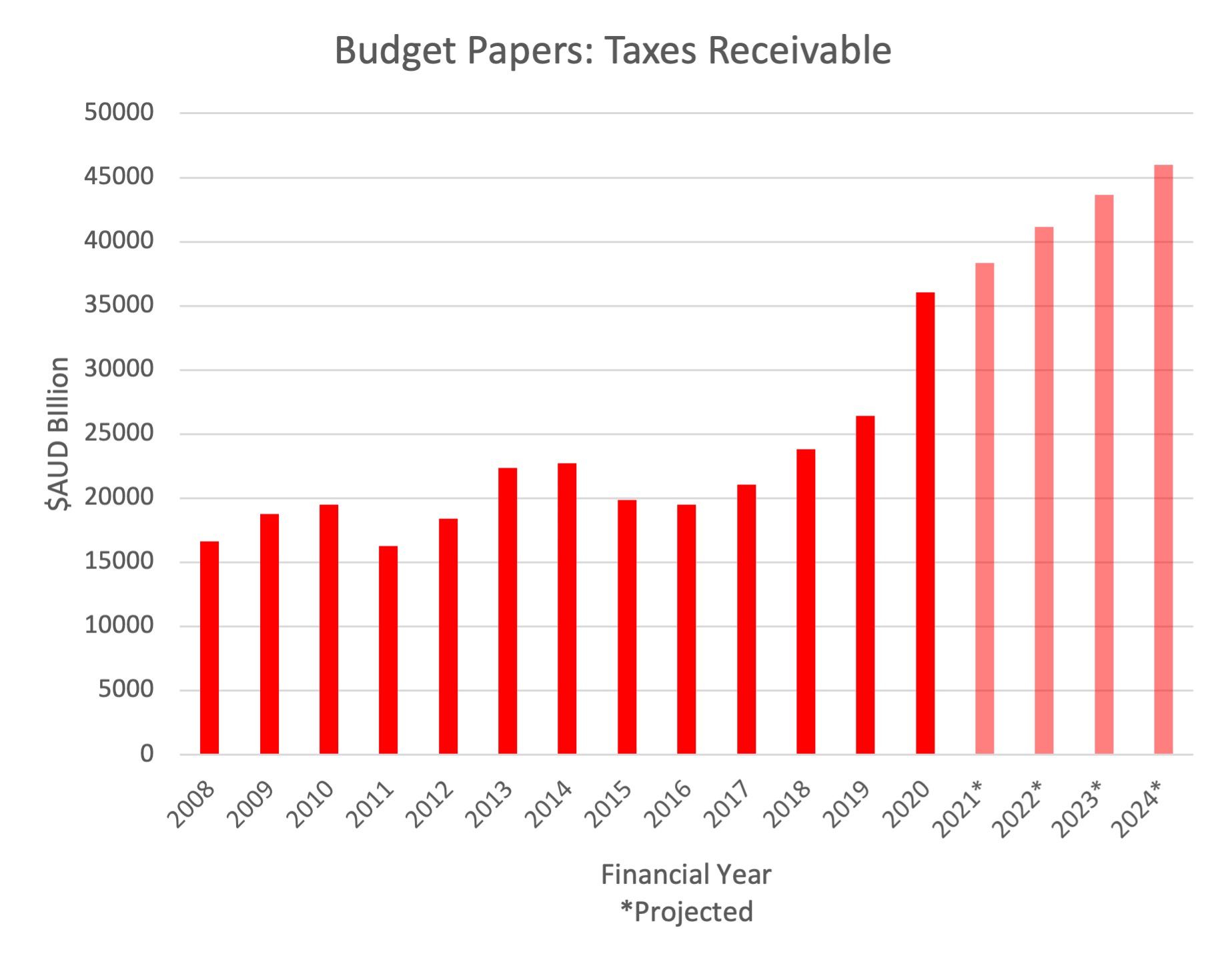

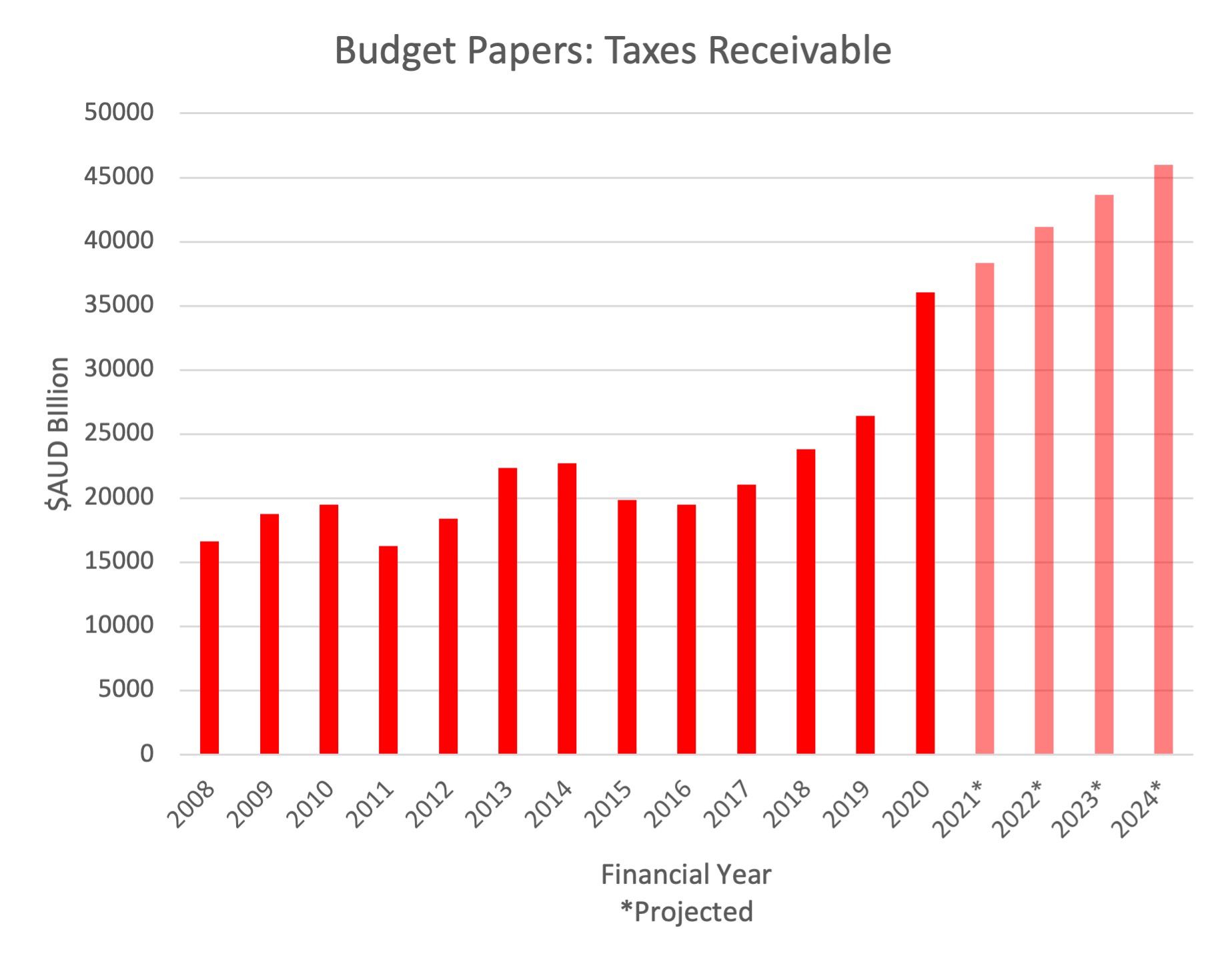

This change in the ATO's collections strategy is reflected in the federal government’s "accounts receivable". In 2015, the budget recorded around $20 billion in uncollected taxes. By 2020, this had risen by $16 billion to $36 billion – that’s about a 75 per cent increase. Tax receivables according to the relevant budget papers is recorded below:

What you see is that the forward estimates show the amount is going to keep creeping up, albeit more slowly, and that by 2025, there will be an estimated $46 billion in taxes outstanding. This means over a 10-year period (from 2015) the amount of uncollected taxes on the federal government’s balance sheet is projected to more than double.

It appears the federal government is yet to come down hard on businesses who are behind in their taxes, so it’s not surprising to see that this uncollected amount is rising. In fact, the 2021 budget papers do not project a surplus in 2022, 2023, 2024 or even 2025 – and budget papers are usually optimistic about future surpluses. The current increase in uncollected taxes may indicate a federal government cash-flow issue. Every business owner knows they need to run a tight debtors ledger. The longer you go without collecting debtors, the less likely it is that they will be recoverable.

ATO tolerance to continue – for now

ATO tolerance to continue – for now

Currently, the ATO is being proactive in asking businesses to set up payment plans if they can’t meet their full tax obligations and has been sending out letters on how they can do this. We expect even greater tolerance in this area from the ATO.

After the pandemic and further lockdowns across the nation, the government wants to support small businesses. But it is good for businesses, especially those that are struggling, to be aware that over the next 12 months the nation will likely be vaccinated, and the federal election will have come and gone. So even if businesses with high tax debts are getting a bit of a reprieve at the moment, it’s not going to last forever.

One interesting development we spotted on the ATO's website, is that in December 2020, it updated the payment plan guidance section to include the removal of the detailed section on demonstrating ongoing viability. While it's difficult to know what the ATO’s actual internal policies are, we can perhaps say that's a hint that the ATO is not spending as much time assessing a business’s viability prior to approving a payment plan.

Up-to-date lodgements are critical

We feel it is more important than ever for accountants and advisers to ensure their clients are up to date with their lodgements. If a company’s lodgements are up to date, then the ATO’s ability to personally pursue directors personally is severely hampered. Unfortunately, we're aware that directors are often hesitant to file their lodgements if they are unable to pay the resulting tax obligation. Directors may feel that filing a lodgement crystalises the corresponding tax debt. As counterintuitive as it may feel, the best way for directors to protect themselves and their business is to ensure that all lodgements are filed on time.

Firms such as ours are able to advise and help businesses who are struggling or concerned about their finances. It's important to be aware that even if a business cannot pay their taxes, they should still report it. The recent changes in insolvency law provide a suite of measures that allow insolvency practitioners to assist with simplified restructuring processes that make it quicker and simpler to assist small businesses with a formal restructure that may result in a reduction of tax debt.

If historically lodgements have not been done on time, the ATO can issue a lockdown director penalty notice to recover PAYG withholding, superannuation guarantee charges, and GST. If businesses have not always met their tax lodgement obligations, then receiving a DPN could result in very difficult circumstances for the directors. Therefore, it’s important to ensure all lodgements are met within the deadlines to avoid this. Even if you can’t pay, it’s important to make sure you report on time, otherwise directors could get stung personally in a severe way.

If lodgements are up to date, there are simply more options on the table to deal with any financial distress. What we've found is that when we are assisting a business with a formal restructure, the ATO always consider lodgement history and often makes bringing lodgements up to date a precondition of supporting any proposals.

Hayden Asper, manager, Jirsch Sutherland

Login

Login