The evolution of the Australian fixed income market is picking up pace. We now have a bill pending in the federal parliament that will regulate exchange traded bonds, commonly known as the ‘Simple Corporate Bond’ bill. While the OTC bond market continues to dominate turnover in the asset class, there’s now a need to discuss what role bonds will play in the self-managed super fund (SMSF) portfolio and what that composition should entail. Clients may need to decide between listed bonds or OTC bonds and there’s the probability that the sophisticated investor will build portfolios based on outcomes rather than investment hubs.

The turnover in fixed income has increased since the GFC, as outlined in the Australian Financial Markets Association (AFMA) transaction data for 2013 (1*). The turnover in sovereign debt (debt issued by both state and federal governments) was $1.8 trillion dollars and corporate issued bonds had a turnover of $800 billion. A key objective for NAB is to bring this level of liquidity to the broader fixed income investor market. At present, this liquidity is between professional counterparties – NAB is working towards providing this access to the SMSF sector.

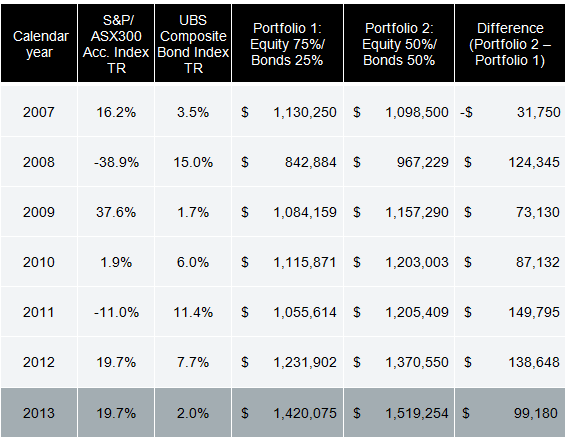

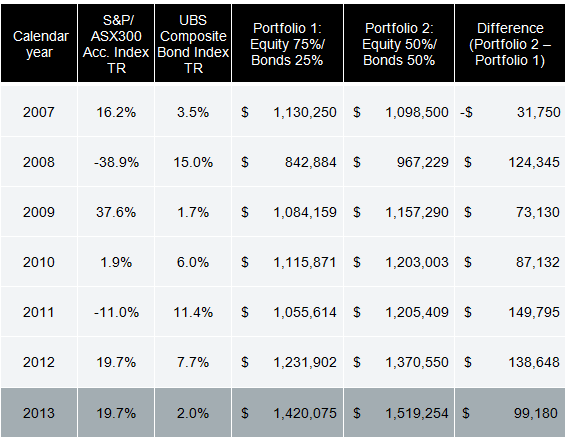

While we have legislators crafting policy and fund managers trading assets, we need to ascertain why these assets will be of value to investors. The GFC is the benchmark for stressed investment scenarios and the GFC period provides ample information on the performance of different asset classes. Over a recent seven-year period, a 50/50 blended fixed income and equities scenario provided some interesting outcomes.

2

2

Most analysts would have focused on the outcomes in this scenario with a 50/50 equity and fixed income split over the period resulting in a substantial increase in the value compared to a blended portfolio of 75/25. Though this is important, in my view, the significant data point to the SMSF sector is the level of volatility in the ASX300 index.

The role that fixed income plays in portfolios is to reduce volatility in performance. The SMSF sector is moving into “bond like” equities, such as the four major banks, Telstra, Wesfarmers and others. For those clients who are intolerant of volatility, their portfolios should be structured so that a component of their portfolio sits higher in the capital structure. Using the data from Mercer, Morningstar and Three Sixty, the MLC advice research team suggests bonds perform well when equity markets don’t.

Throughout 2014, we’ve seen both equities and bond markets perform strongly, as clients continue to chase yield. As these markets reach new highs, some advisers are starting to rotate clients out of assets that are perceived as riskier into higher rated assets. These advisers believe clients are not currently being compensated for the risk. If advisers’ concerns are correct, when markets sell off the less volatile higher rated assets, they’ll outperform the riskier assets on a relative value basis.

Disclaimer

The information contained herein has been prepared by National Australia Bank Limited (ABN 12 004 044 937, AFSL 230686) (“NAB”). The information does not constitute, in any jurisdiction, a recommendation, invitation, offer, or solicitation or inducement to buy or sell any financial instrument or product, or to engage in or refrain from engaging in any transaction. It is not the intention of NAB to create legal relations on the basis of the information contained herein. No part of this document may be reproduced, copied or distributed without the prior permission of NAB. All material presented in this document, unless specifically indicated otherwise, is under copyright to NAB.

National Australia Bank trade mark is registered in Australia, Hong Kong, New Zealand, EC, Singapore and the UK (registration applications pending in China, India, Japan and the US).

1 AFMA Financial turnover 2013

2 ThreeSixty, Mercer, Morningstar

**Promoted by NAB**

Login

Login

2

2

You are not authorised to post comments.

Comments will undergo moderation before they get published.