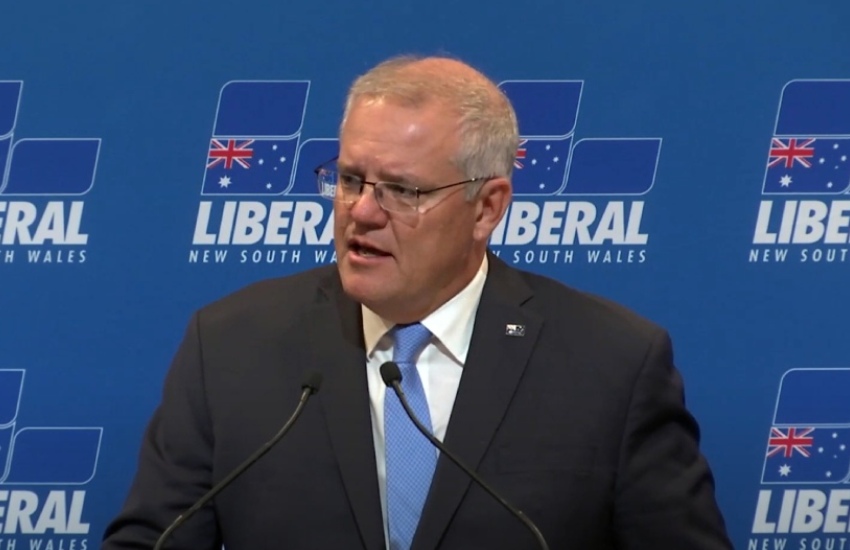

“This is the worst time that you could increase taxes on the Australian economy,” Mr Morrison said. “This is self-defeating; to put up taxes on Australian businesses looking to employ people as we come out of a COVID pandemic and recession is irresponsible.

“If you put up taxes when an economy and businesses are looking to get up on their feet, it just knocks them down again. You knock businesses down, they don’t employ people. More people go onto welfare, more people aren’t paying taxes.

“It is not the economically responsible thing to do to put a big tax handbrake on job creation as you’re recovering from a pandemic.”

Victorian state Treasurer Tim Pallas last week announced that the Victorian government will move to introduce a suite of targeted revenue-raising measures in Victoria that will target luxury property investors and buyers, landlords and gender-exclusive private clubs.

The first of the new measures is an increase to stamp duty. Mr Pallas said his government will move to increase payable stamp duty for property transactions worth more than $2 million to $110,000 plus 6.5 per cent of the dutiable value in excess of $2 million.

Victoria’s land tax is set for an increase, too, in a bid to raise $380 million a year from 1 January 2022. The tax rate will rise by 0.25 of a percentage point for landholdings worth more than $1.8 million, and 0.30 of a percentage point for those worth more than $3 million.

The announcement also unveiled a new windfall gains tax, introduced in a bid to raise an estimated $40 million a year. It will see some developers planning to rezone land pay a tax of up to 50 per cent.

For windfalls over $500,000, taxpayers will pay 50 per cent, with the tax phasing in from $100,000. Meanwhile, land that fits the Growth Areas Infrastructure Contribution criteria won’t be affected.

The Andrews government estimates that hiking stamp duty will claw back $137 million and impact less than 4 per cent of property transactions across the state over the next financial year.

The Prime Minister’s criticisms of Victoria’s new revenue-raising measures are the latest in a series to raise questions over their timing and efficacy.

Elinor Kasapidis, senior manager of tax policy at CPA Australia, last week said the Andrews government may have moved to collect from big business too soon, and may risk driving developers and landowners away to other states at a time when investment is key to the state’s recovery.

“Victoria faces several recovery challenges. Many sectors and regions are still hurting. It’s too soon to focus on budget repair,” Ms Kasapidis said.

“Eventually, Victoria will have to pay off its pandemic debt. But by seeking to raise tax revenues at this stage of the economic cycle, the Victorian government risks damaging the state’s recovery.

“It doesn’t make sense to impose new costs on businesses and investors now. People and money are mobile. New taxes will undermine confidence and may drive them away.”

Facing questions over whether the debt left in the wake of his own government’s federal budget was “irresponsible”, Mr Morrison said that a strong economy “will offset” the debt.

“You cannot pay for the National Disability Insurance Scheme with high unemployment,” Mr Morrison said. “You cannot pay for the National Disability Insurance Scheme if you’re running your economy into the ground.”

The Morrison government’s 2021–22 federal budget left Australians with a $106.6 billion deficit, with net debt to peak at $980.6 billion by June 2025.

Login

Login