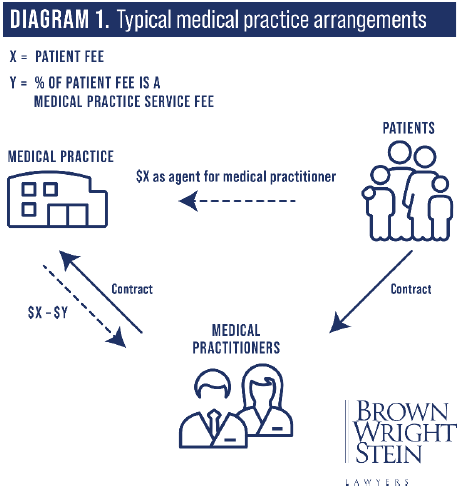

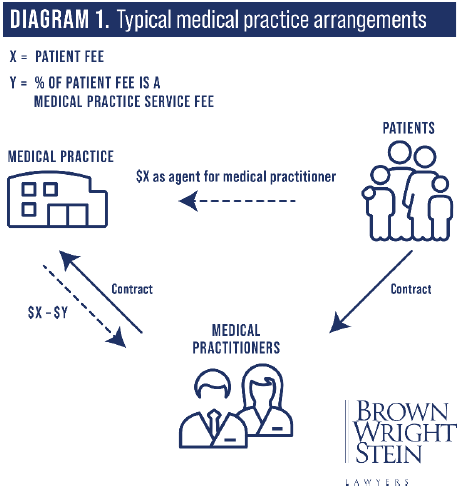

This is one of the most common business arrangements used in the optometry industry. The practice collects the fees from the patient, deducts a fee for providing the management service (usually to cover rent, administration staff, marketing, practice supplies etc) and then pays the remainder to the actual optometrist.

The payments by the practice to the optometrist are commonly treated as fees or revenue earned by the optometrist rather than wages. Wages are subject to payroll tax. This is because money being paid to the optometrist was considered theirs already and was simply being held by the practice on trust.

What is wrong with this arrangement?

In Commissioner of State Revenue v The Optical Superstore Pty Ltd [2019] VSCA 197, it was determined that these payments could be subject to payroll tax. If your practice uses this structure, you could be required to pay payroll tax. If that is the case, you may also be required to pay, in addition to the unpaid tax for the past five years, up to 25 per cent of the taxed owed for the past five years as a penalty and interest.

What happened in this case?

The case was between Victoria’s Office of State Revenue and The Optical Superstore. The Optical Superstore has more than 65 stores across Australia selling eyewear and optometry services.

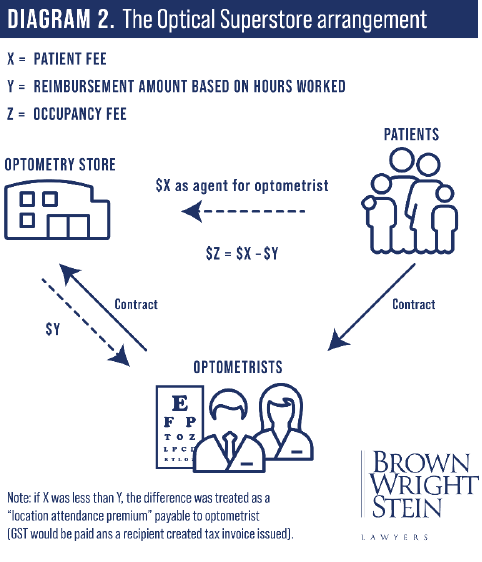

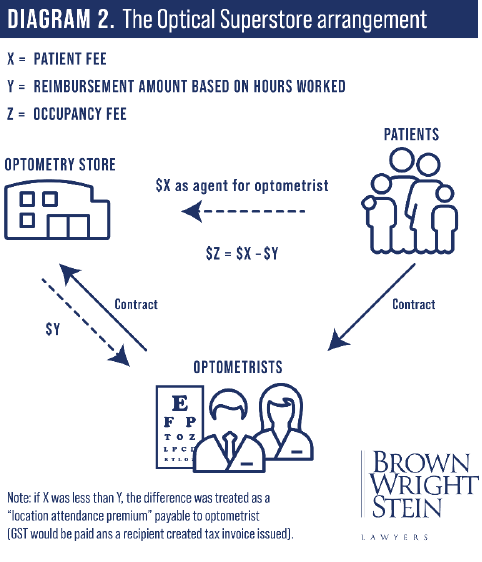

1. The optometrist treated patients inside a consulting room at a store.

2. The fees, whether they were paid by the patient or Medicare were put (at the optometrist’s direction) into The Optical Superstore’s main operating bank account. The fees were held “on trust” for the optometrist but, importantly, were not held in any form of separate or sub-account.

3. Each month, The Optical Superstore paid the optometrist a “reimbursement amount” based on the hours worked by the optometrist.

4. Each optometrist would submit their hours to the store manager for sign off. Then payment would be made to the optometrist.

5. The optometrists were not providing invoices to The Optical Superstore.

6. An “occupancy fee” was deducted from each optometrist’s payment equal to the gross consultation fees (what the patient actually paid) less what was paid to the optometrist (patient fee = “occupancy fee” + “reimbursement amount”).

7. If the gross consultation fees were less than the amount that the optometrist was entitled to, based upon their hourly rates, the difference was treated as a “location attendance premium” (GST would be paid and a recipient created tax invoice issued).

What made The Optical Superstore case so special?

What is not usually seen in a medical practice structure is:

1. The optometrist’s fees were based on hours worked — like a “normal” pay structure for an employee.

2. The “location attendance” premium.

3. The optometrist’s effective time sheet was signed off by the store manager (like a “normal” employee).

4. The Optical Superstore was also selling products in conjunction with the optometry services.

The Victorian Commissioner considered the agreement between the optometrists and The Optical Superstore a “relevant contract” for work according to the laws around payroll tax. This meant that the payments made to the optometrists should be treated as wages from a tax perspective. This means that they are therefore grouped together across the stores and subject to payroll tax.

But my setup is different to The Optical Superstore

The Optical Superstore had special features such as the location attendance premium and the sale of products with services. This is not always the case with more traditional structures. What is of concern is that the judge in the Supreme Court of Victoria adopted a broad view of what constituted a contract for work. This means that these types of structures could be reviewed in the future and may require you to have a discussion with a tax professional to assess your risk.

The new focus on payroll tax issues

Australia-wide, over 90 per cent of state payroll tax investigations identify non-compliance. The chances are, if you are audited, you will be found to be non-compliant.

In 2016–17, Revenue NSW audited 7,957 businesses for payroll tax. Almost a third of these businesses were unregistered for payroll tax; 97 per cent of the unregistered businesses were found to be required to be registered.

When do you need to register for payroll tax?

The first point is your payroll must equal $900,000. This is where it gets tricky, as there are several rules around how your payroll is quantified and this includes what entities are grouped together to form the total payroll. The best is to seek legal advice.

Matthew McKee, Partner; Gillian Tam, Associate; and Rose McEvoy, Graduate, Brown Wright Stein Lawyers

Login

Login