From better client relationships to faster data retrieval, we reveal the true strategic benefits of automated workflows – and why it’s so important.

From better client relationships to faster data retrieval, we reveal the true strategic benefits of automated workflows – and why it’s so important.

For decades, the accounting industry has been hampered by repetitive, time-intensive tasks. Whether it’s accounts payable, invoicing, data entry or template generation, accounting professionals have traditionally spent most of their days working on non-creative administrative activities.

Thanks to the advent of automated workflow technology, however, they can now focus their skills on client-facing and income-generating ventures. Here, we explore five of the strategic benefits in-depth.

1. Greater accountability and transparency

Accountants are often tasked with juggling a multitude of jobs across a range of different clients. This increases the complexity of their day-to-day tasks while also contributing to more errors.

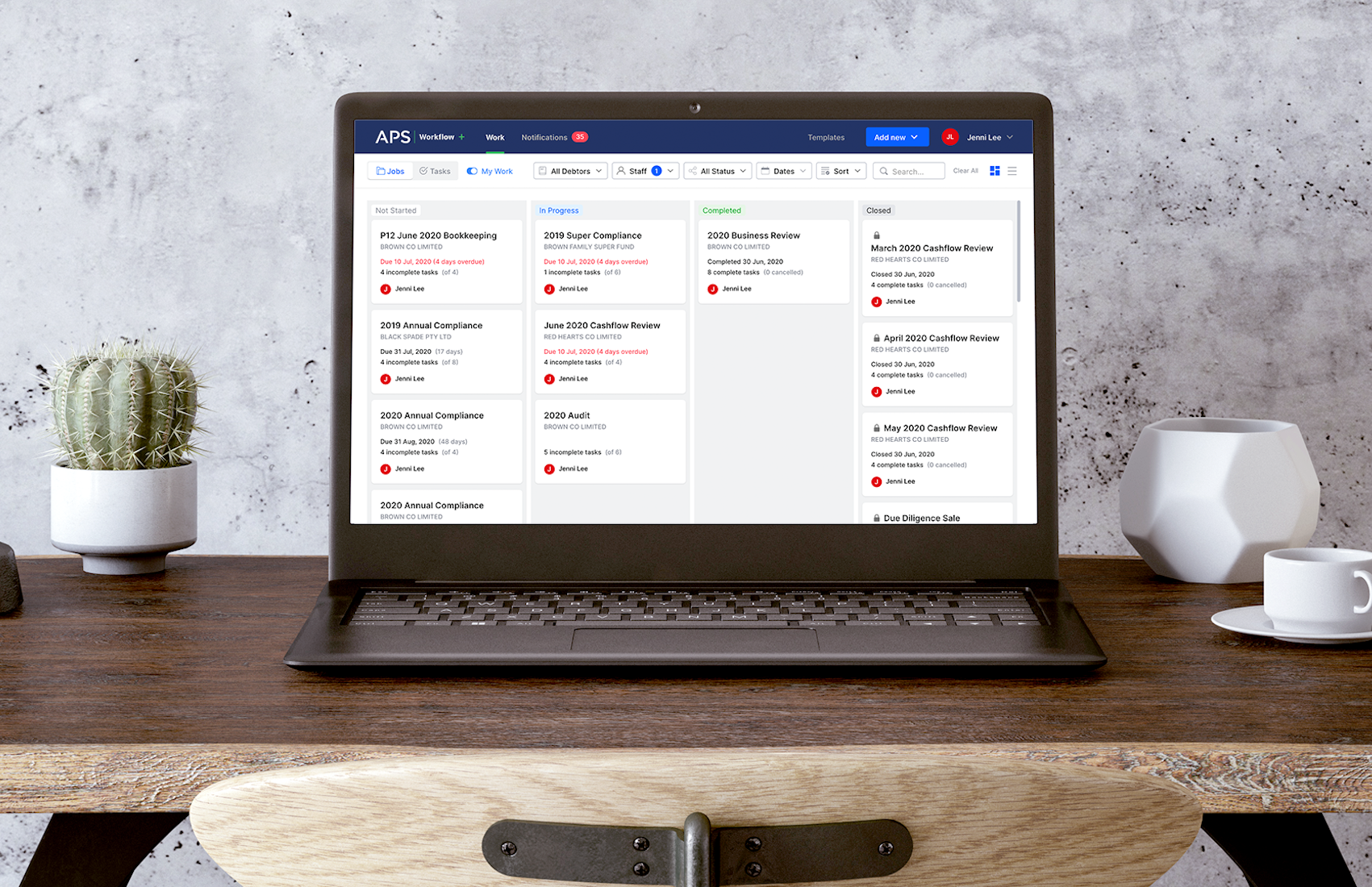

With an automated workflow solution, tasks can be assigned and monitored in real-time, providing greater transparency for employees and their managers. It also improves accountability, with job progress able to monitored at a glance, and the ability for team leaders to identify high-quality performers.

It will also reveal any bottlenecks the team may be experiencing, and with full oversight over past, current and upcoming projects, managers can use the real-time information at their disposal to streamline tasks, assign different staff to specific projects and free up team members to focus on more time-sensitive jobs.

2. Better relationships with clients

With clients demanding more from their accounting professionals – and practices needing to diversify their offering in order to survive in an increasingly competitive industry – business owners must grasp every opportunity to enhance their client communications.

Workflow automation provides exactly that by acting as a single source of knowledge where all information on a particular client lives permanently. You will have a detailed overview of all past interactions with clients as well as their responses (if any). This means you can deploy custom marketing strategies to retain your current clients and reach out to warm leads – all while reducing the risk of overwhelming them with too many messages.

3. Collaboration is faster, easier and more profitable

Modern practices must create a collaborative environment where knowledge and insights can be shared freely for the benefit of the entire organisation. A comprehensive workflow automation solution means every team member is working within the same ecosystem and exposed to the same information.

So long as adequate training is provided, accountants can use the system to share documents, spreadsheets and other project materials to complete their tasks faster. This means a better bottom line for the practice and – arguably just as important – a more unified, happier and productive team.

4. Faster – and more accurate – data retrieval

Any practice looking to thrive in the modern accounting world must cast off the shackles of paper-based systems and cluttered physical storage rooms. Such outdated practices can delay jobs, create confusion among accountants and even lead to the loss of sensitive data.

Instead, an automated workflow solution acts as the practice’s single source of data. Team members can retrieve specific files within seconds and share documents with co-workers and clients as needed. Data storage is also a breeze, with simple functions for naming, categorising, storing and archiving information. This speeds up the time it takes to complete a job while eliminating bottlenecks and making your sensitive data much more secure – especially when backed up to the cloud!

5. Fewer errors – and happier clients

Old-school processes are mired in errors. That not only increases stress levels for the team – while causing them to spend more time on projects as they double- and triple-check their accuracy – but it puts your practice at greater risk of losing clients.

Automated workflow software drastically reduces the risk of human error. Information only needs to be entered once and can then be pulled into a template at any time. Any errors that do slip through the cracks only need to be adjusted with a single keystroke – rather than requiring all the information be re-entered into the system.

That means your digital accounting database is more accurate and easier to retrieve than any physical stores of information.

Automated workflow technology is the future for all good accounting practices – but not all solutions are created equal. Learn more about how APS Workflow can boost your firm’s output and streamline everyday activities by booking a consultation with us today.

APS is a division of Reckon, an ASX listed company. We develop the software used by the best Accounting firms in Australia and New Zealand to run their business’ and advise their clients.

You are not authorised to post comments.

Comments will undergo moderation before they get published.